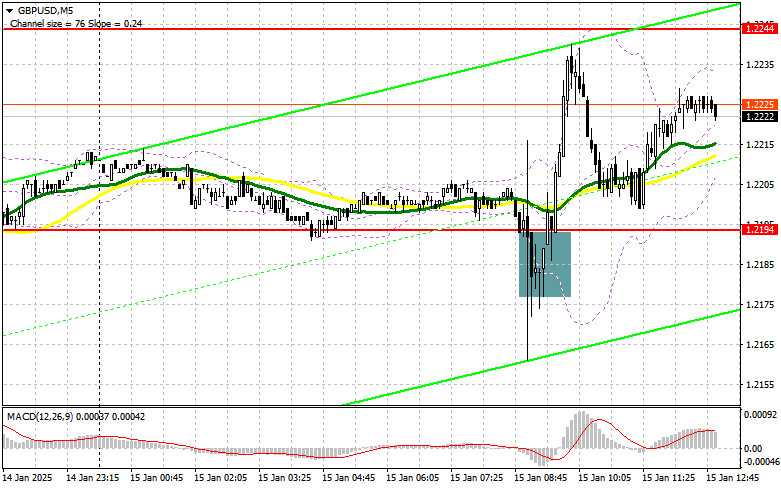

In my morning forecast, I highlighted the 1.2194 level as a key decision point for market entry. Let's review the 5-minute chart and analyze what occurred. A decline followed by the formation of a false breakout provided a good entry point for buying the pound, resulting in a 40-point rise. The technical picture for the second half of the day remains unchanged.

For Long Positions on GBP/USD:

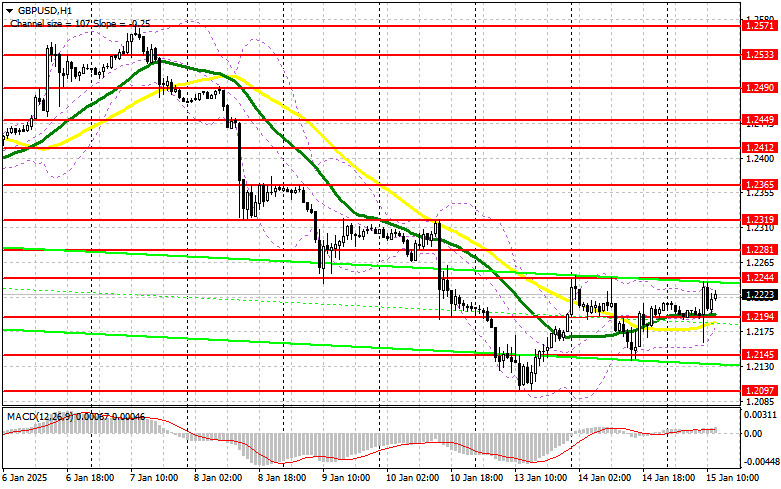

News that UK inflation came in lower than economists' expectations spurred pound purchases. However, as shown on the chart, active growth with a new weekly high has yet to materialize. Clearly, traders are awaiting US data, including December inflation figures, which will significantly influence the pair's dynamics. The Consumer Price Index (CPI) and Core CPI (excluding food and energy prices) will determine the pair's next direction. Only very weak data could sustain the pound's growth, as it continues to struggle against the U.S. dollar.

- In case of a decline, I plan to act on buying opportunities only after a false breakout near the 1.2194 support level, similar to the scenario described earlier.

- The target will be a recovery toward the 1.2244 resistance level, which remained untested earlier in the day. A breakout and retest of this range from above will create a new entry point for long positions, aiming for 1.2281. Buyers will likely face significant challenges at this level, with the ultimate target being 1.2319, where I plan to lock in profits.

If GBP/USD declines and bulls show no activity near 1.2194, the pound may drop further. In that case, a false breakout near the 1.2145 minimum will be the only valid condition for opening long positions. Immediate long positions will be considered near 1.2097 for an intraday correction of 30-35 points.

For Short Positions on GBP/USD:

Pound sellers attempted but failed to take control of the 1.2194 level, given the high likelihood of the Bank of England maintaining a hawkish stance on rates, which policymakers cannot afford to abandon amidst economic slowing.

- In the second half of the day, it's best to confirm the presence of bears at the 1.2244 level, where a false breakout, triggered by US data, will provide a solid entry point for short positions, targeting 1.2194.

- Moving averages align at this level, supporting buyers and making it a critical zone. A breakout and retest of 1.2194 from below will trigger stops, opening the way toward 1.2145, signaling a strengthening bearish market.

- The ultimate target will be 1.2097, where I plan to lock in profits.

If pound demand recovers in the second half and bears do not show activity around 1.2244, I will postpone short positions until testing the 1.2281 resistance. Shorts will be opened there only after an unsuccessful consolidation. If no downward movement occurs, I'll look for short opportunities near 1.2319, aiming for an intraday correction of 30-35 points.

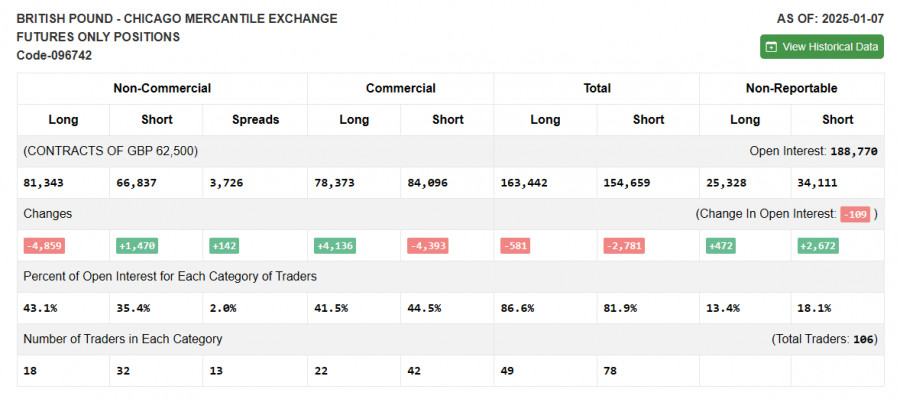

Commitments of Traders (COT) Report:

The COT report for January 7 indicated an increase in short positions and a reduction in long positions. Overall, the balance of forces has not significantly changed, and the pound continues to lose ground against the US dollar despite a predominance of bullish positions. Upcoming UK inflation and GDP data could complicate the Bank of England's future decisions, reducing the likelihood of a significant rise in GBP/USD.

The report shows long non-commercial positions decreased by 4,859 to 81,343, while short non-commercial positions increased by 1,470 to 66,837. The net gap between long and short positions widened by 142.

Indicator Signals:

Moving AveragesTrading is above the 30- and 50-day moving averages, indicating further growth potential for the pair.Note: Moving averages are based on hourly (H1) chart analysis and differ from classic daily (D1) moving averages.

Bollinger BandsIn case of a decline, the lower boundary of the indicator around 1.2190 will act as support.

Indicator Descriptions:

- Moving average (MA): Indicates the current trend by smoothing out volatility and noise. Period – 50 (yellow on the chart); Period – 30 (green on the chart).

- MACD (Moving Average Convergence/Divergence): Indicates divergence between fast (EMA-12) and slow (EMA-26) moving averages. SMA period – 9.

- Bollinger Bands: Identifies volatility and potential reversals. Period – 20.

- Non-commercial traders: Speculators such as individual traders, hedge funds, and institutions using the futures market for speculative purposes.

- Non-commercial long positions: Total long open positions held by non-commercial traders.

- Non-commercial short positions: Total short open positions held by non-commercial traders.

- Net non-commercial position: Difference between short and long positions of non-commercial traders.